|

|

|

|

|||

|

|

Client Update - quarterly newsletter |

|

|

|

|

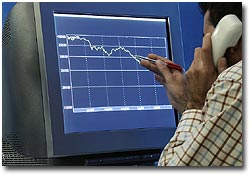

Professional Tax Planning, Advisory, Preparation, andCompliance Service for Investors, Full-Time Traders, andHobby Traders; in Stocks, Bonds, Crypto, and Bitcoin.Thanks for logging-on to this webpage to get RELIABLE and DETAIL information that you need. Starting January 26, 2026, the IRS will accept 2025 Individual and Corporation Tax Returns. A Corporation is required to file a Tax Return Every Year, whether or not it had Income during the Year:- (IRC Section 6012). The Trading Industry is ONE of SIX major economic sectors that this Company serves; and we are PROFICIENT at meeting Clients expectations. We prepare Tax Returns for Over 300 Clients. The TURN-AROUND time is 3-5 days AFTER ALL their documents are received. Clients execute their Trades on the NYSE; LSE; NIKKI; FOREX; E*TRADE; SCHWAB; VANGUARD; FIDELITY; MERRILL; MORGAN STANLEY; T-ROWE PRICE; and J.P. MORGAN SECURITIES. Their Trades and Compensations are listed on Forms 1099 and on Partnership and Corporations K1. We saved our Clients over $450 million in taxes. Hence, they have more LIQUIDITY(Cash-Flow), DISPOSABLE INCOME, and WORKING CAPITAL that had enabled them to maintain their PERSONAL and BUSINESS Financial Obligations and CREDIT-WORTHINESS. We are READY to work with you, if Exceptional Results and Peace of mind are Important to you. If you need to contact the IRS from inside the USA, Call the IRS (800) 829-1040 and (800) 829-4933 from 7:00am Eastern Standard Time(EST). Calling from outside the USA (267) 941-1000 and (313) 234-6146, from 8:00am EST. The website is IRS.GOV. What do you want us to do for you TODAY?

Our Clients Testimonials From Our Survey Report 1) "I am an engineer onboard a ship. My wife is a full-time stock trader. She trades from home, and she also manages our rental properties. Every year we mail our documents to Barry. We have received credit for mailing and he pays to return our original documents to us. His company has exceeded our expections, and we are happy with the results and the relationship we have with him."- J. Newton (Toms River, NJ). 2) "I work in the skills-trade industry. I am also a full-time trader for 10-years. Doing business with Barry has been great."- R. Dennis (Manhatan, NY). 3) "Thanks for helping me report my trades on T.Rowe Price Forms 1099-B onto my tax return. I could see that you are quite familiar with those transactions by how you quickly and skillfully analyzed them". E. Frazer - (Culver City, CA). Our Clients pay their choice of courier (UPS; FedEx; DHL; Post-Office) to deliver their ORIGINAL documents to us. We give them up to $30 reimbursement and we pay the Post-Office (regular delivery rate) to return their documents and a copy of the Tax Return that we prepared for them.

We use every Regulatory Tax Loophole to help our clients keep more of their money; and we put a BIG smile on their faces. Our CONTINUALLY Updated Tax DATABASE contains over 1,000 Tax Strategies that are unique to this industry. It enables us to use the BEST Tax-efficient structure that will MINIMIZE your Tax Liability; and MAXIMIZE your Cash-Flow and Disposable Income. The Minimum Price to Prepare and File a Tax Return that contains Trading Transactions is $1,275.00 (Less $30.00 credit for mailing your documents to us).The Fee is a RE-COUPABLE Tax-Deductible expense. Hence, you have nothing to lose. In addition, it is an INVESTMENT you made to MINIMIZE your Tax Liability and MAXIMIZE your Cash-Flow and Disposable Income. PLUS, you are in Capable Hands because we are proficient at managing expectations; and we have a Proven and Verifiable Track Record. Hence, you get Exceptional Results and Peace-of-mind; and you have NOTHING to lose ("The Domino / Ripple / Multiplier effects"). Testimonials that we have received during our annual Traders/Investors survey are overwhelmingly impressive. Compare that alongside the TOTAL amount of money you have LOST in the Stock Market, Crypto Currencies, Casino Gambling, Sports Betting, Race Track Betting, Lottery Tickets; and people that owe you money and will never pay you. If you plan to file your tax return AFTER April 15, you can avoid paying a Late Filing Penalty of $220 to the IRS and $200 to the State PER MONTH(IRS calls it, "Enforced Compliance"). Go to IRS.GOV; and file extension Form 4868 for an Individual and Form 7004 for a corporation. The IRS HOTLINES (800) 829-4933 OR (800) 829-1040 from 7am Eastern Standard Time(EST).

Industry Related Education & Training *MS Taxation. *IRS Enrolled Agent(EA) -1989 to Present. (48 hours of IRS Riugorous and Mandatory annual continuing educations). *PwC and Merrill Lynch (Internships). *Green Traders Tax Seminars. *NYU (Annual Continuing Education). Research Companies:-(WG&L, Thomson Reuters, CCH, and Wolters Kluwer).

Lets get to the specifics!! At Barrys Accounting Services Corp., we have helped many traders file Simple and Complex tax returns for many years. A change in their tax bracket has drastically reduced their tax liability (Marginal & Effective Tax Rate). Hence, you are in Capable Hands with us. According to the Tax Code, Traders are classified into TWO categories:- #1) Investors and Hobby Traders (or part-time traders):- According to the IRS rules, they must pay Capital gains tax on profits; and they can only deduct a Maximum net loss of $3,000 per year. Excess loss is carryover and deducted in future years. #2) Full-time traders :- According to IRS rules, you are qualify as a Full-Time Trader if you derive and depend on making your living from the profit on Short-Term sales of stocks for your trading account. a)Dealers in Securities(IRC-1236) and Full-time traders must file a TIMELY application with the IRS and ELECT the Mark-to-Market election(IRC-475(f). If you want to make the Mark-to-Market election, call the IRS (800) 829-1040 from 7:00am EST. The webite is IRS.Gov. If you wish to set up an LLC or Corporation, call Legal Zoom (855) 787-1221; or (833)799-4891. b) A Full-time Trader who makes a profit is qualified for the 20% QBI deduction. The Trader can deduct ALL Trading and Business expenses (IRC-162) and losses incurred during the tax year. ALL Gains & Losses are treated as Ordinary gains & Losses(IRC-165(c)(1); Wash Sales (IRC-1091); Depreciation (IRC-167); Bonus Depreciation (IRC-179) and Amortization(IRC-197) are also fully deductible. c) A Full-time Trader is required to keep Daily Time-sheet, Books and Records of Trading Activities to substantiate his/her claim as a Full-time Trader.(Regulations 1.6001-1(a); and 601.105). d) Tax Preparers/Practitioners Penalty - IRC sections 6694 and 6695. We are experienced in Trade Tax Laws, and we use the same Tax Research Companies that the IRS and State Auditors use (Thompson Reuters, WG&L, CCH, RIA, and Prentice-Hall). PLUS 48 hours of Rigorous and Mandatory Annual Continuing Education.

We have handled securities and trading issues such as section 83(b) Stock Election; Section 988 trades; Section 1256 contracts; Mark-to-market tax return; Short sales; Wash sales; Futures & options; Stock splits; Dollar cost averaging; Dividend reinvestment plans; Margin interest; Investment interests; Dividends; Foreign tax credit; Investment expenses; Investment tax credit; Unreimbursed business operating expenses; Home office deductions, etc. ***NOTE:- We also file Tax Returns with the IRS and FinCEN for clients who must report/declare Foreign/Offshore Bank Account(FBAR), and other asset transaction in accordance with the Foreign Account Tax Compliance Act (FATCA).

#1)Question:-"I was defrauded in a ponzi scheme. I gave a broker $10,000 to invest in stocks and I loss everything. Can I claim this loss on my tax return?" Answer:-You can receive a tax deduction if you receive a Form 1099 from the investment company or Broker.You can also get a tax deduction if a broker defrauded you and others and the crime and your loss are documented by an Attorney in a Class Action Lawsuit, or the crime is documented by the SIPC, FBI and SEC. Please Send/Bring us your proof.

#2)Question:- "I am a Full-time Trader. I have already made the Mark-to-Market election and filed the required forms with the IRS. I am looking for a stable Tax-Accountant to prepare my taxes every year. Would your company be able to prepare my Federal & State tax returns this year and in future years? Answer:- Yes! we will prepare and e-file a complete Federal & State Tax return for you; and we will send you a copy plus ALL the documents you send us via the Post Office(USPS). Send us a copy of the last Tax Return that you filed including your trading documents; and other tax deductible documents. Our clients send us their Tax and Trading documents by FedX., UPS., DHL., and the Post Office(USPS). We give our Trade clients up to $30 credit for postage/mailing; and we pay to return ALL the documents they sent us and a copy of the tax return that we prepared for them. Hence, they have NOTHING to lose.

#3)Question:- I buy and sell stocks throughout the year. I would like to elect the Mark-to-Market election for full-time traders. Can your company help me make the elcetion? Answer:- You are responsible for preparing and filing the "Mark-to-market" election form with the IRS. However, we can prepare and e-file your Federal and State Tax Returns with the IRS and State. You can call the IRS at (800) 829-3676 and (800) 829-1040, from 7:30am Eastern Standard Time.

#4)Question: - "I am working for a hedge fund company. I am part of a 4-man team there and I am paid as an independent contractor. I would like to form my own Corporation or LLC while I continue working for this company. I would like to organize it so that it does not resemble a sham. Please advise if this is something you can help me with. Thanks. Answer:- You are presently an Independent Contractor. Therefore, get a name for your business and set up your Business Trading Entity as a Sole-proprietorship, LLC, or C-Corporation. Call Legal Zoom (855)787-1221 and (833)799-4891 for help with setting-up and getting the Federal ID Number (EIN) from the IRS. Most importantly, ask other Traders whom you know, what businiess entity they are operating under (Sole-Proprietorship, LLC, C-Corp, etc). Their feedback will certainly boost your confidence that you are on the right track. FINALLY, use the details that I mentioned above for Full-Time Traders.

Other Services We Provide Traders & Investors *Tax Planning *Financial Planning *Franchise Advisory. *Real-Estate Advisory. *Insurance & Risk Management.

*****NOTE:- My best selling book, "Sweet Success" by Clemson Barry, is on Amazon.(Paper back and Kindle).

Click here for "Financial Planning & Wealth Management" Click here for "Business Valuation" Click here for "Real Estate Taxation & Property Insurance"

|

|||